Hello everyone!

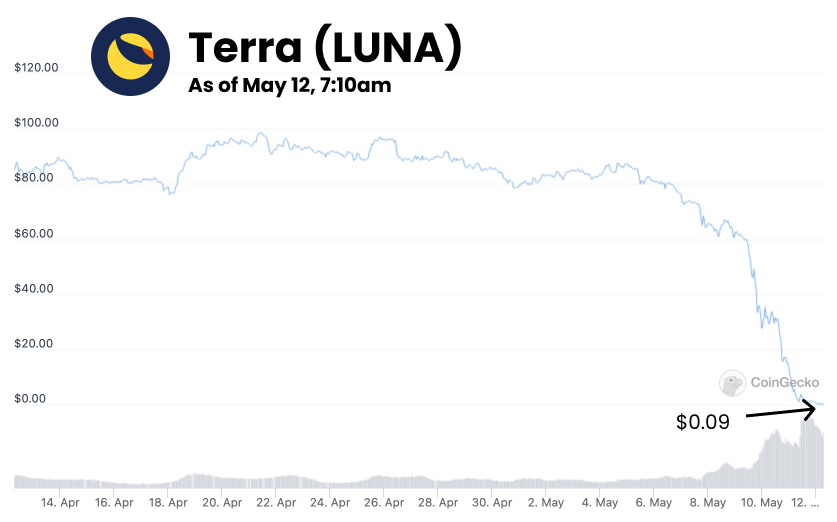

What a week it was in crypto (and the broader tech markets). Remember that exciting project, Terra? It imploded in a matter of days, erasing over $20B in value. Technology as a category has not been having a great year in the markets. But when you look closer, many companies are still making fundamental progress irrespective of their asset prices. Some stuff will fail, some won't, but there's plenty to learn either way. So with that, let's jump into 3 reads, 2 tweets, and 1 podcast for the week:

Reads

This was the most accessible explanation of the Terra ecosystem's implosion. It's a guest post by John Wu, who also posted an incredible thread on what happened.

The Terra ecosystem revolved around algorithmically maintaining the stability of UST, its stablecoin, by using a clever mechanism with its governance coin, LUNA. Given this wasn't the traditional approach of backing each coin with a dollar, it was under-collateralized and carried significant risks. But the ecosystem marched on. All was going well (UST was stable, people used variations for actual transactions internationally, etc.), which is why plenty of firms and people (including yours truly) got so excited. The technology was cool, real people were using it daily, and it had developer momentum. But here's what we missed. With risky, novel projects like this, we've got to pay extra attention to "tail risks": the project's vulnerability to extreme risks. These risks are low probability but are cataclysmic to fragile projects.

Terra's tail risk became reality and it was too fragile to handle it. An "attacker" with over $1B in UST made progressive, massive sales, knocking off UST's "peg" to the dollar. UST's fundamental purpose was to be consistently worth a dollar, so losing this stability led to panic selling. But the only way to sell UST is to turn it into its sister coin, LUNA. So LUNA’s supply rose, even though LUNA's demand was in free fall as people fled the ecosystem. All this led to a death spiral: selling UST kept increasing LUNA's supply, but nobody wanted to hold LUNA, so its demand plummeted as its supply skyrocketed. That self-reinforcing feedback loop is why LUNA’s price crashed 99% and why you'll see the word "death spiral" pasted all over the project.

This breakdown reminded me of a book by Nassim Taleb: Antifragile. He discusses 3 "stages" of fragility:

Fragile systems break under stressors/shocks

Robust systems sustain under stressors/shocks

Antifragile systems grow under stressors/shocks

It's a valuable reminder to bucket new projects into these categories by playing out such extreme scenarios. In Terra's case, diligently exploring what happens if a $1B attack occurs would probably have helped more people stay vigilant. It didn't work out this time, but lesson learnt for the next one!

I need a big cup of coffee to get through the posts, but I've been loving this blog. It does a fantastic job of analyzing public earnings to elicit software stack and cloud trends.

This particular issue explores the evolving competitive dynamics in cloud computing. Whenever you see a new data infrastructure company, it's easy to imagine a world where hyperscalers (AWS/Azure/GCP) either snatch them up or copy them. That's usually what happened in the early days, but it's shifting rapidly today.

As these narrower solutions (for example, Snowflake's data warehouses or MongoDB's NoSQL databases) surpass hyperscalers in usability and feature-richness, the hyperscalers (AWS/GCP/Azure) emphasize cooperation over competition. They're so occupied with winning cloud workloads from each other, that they're more inclined to partner with these individual providers instead of stamping them out. After all, these solutions are typically built on the hyperscalers, so cooperation still poses a massive win-win situation!

That last point is fascinating because it’s a twist to disruption theory. Disruption theory usually involves an upstart targeting an under or over-served market segment to eventually displace incumbents. But what if the upstarts are built on the incumbents? That's playing out in the cloud today (new infrastructure companies just use AWS/GCP/Azure’s storage and compute in novel ways), and it looks like it's settling on some balance of being partners and competitors. For instance, if MongoDB is built on AWS and steals database customers, AWS still profits because they supply the underlying storage! I wonder how this will play out over time though – are hyperscalars cooperating to buy time, is profit-sharing over niche solutions "good enough", or will upstarts find some novel way to displace them?

Well-behaved bubbles often make history

99% of the time, people use "bubble" derogatorily. We often call the top, say "I told you so" and leave it at that. But bubbles are more profound than a mass money grab. Their very irrationality is the coordinating mechanism that results in better futures!

This is a thoroughly thought-out article on how to think about bubbles and how, historically, they've prepared the world for future innovations. For instance, the '90s telecom bubble created cheap fiber, making things like Youtube easier when we were ready for it. This concept of coordination through irrationality stretches beyond financial markets or technology too, and the author covers how you see it throughout history in personal, political, and professional areas. We're going to hear a lot more talk about the bubble bursting, but this is an important reminder on how to look for the positive knock-on impacts of bubbles (especially after they burst).

Tweets

This was one of my favorite finds this year. The image with all the concepts it covers is no exaggeration either. Using the "devil's card game" (where you draw 11 cards, 10 of them double your money, one divides it by 2048), this thread weaves together different approaches to cover everything from investing to psychology. I especially like how it starts with a pure "economic" strategy (maximizing the expected outcome) and then works in psychological aspects with the utility of money, our aversion to losses, and how we easily fall for sunk cost traps. I rarely get through long Twitter threads, but this one was well worth it.

This was a superb thread on decision-making. One key takeaway for me is to optimize for one thing. It's easy to fall into the trap of optimizing for multiple variables. But more often than not, one variable is way more important than others. Identifying that variable fosters clarity. While geared towards investing, he also combines this framework with seeking simplicity to outline examples across personal and professional decisions. A simple lesson, but well worth the reminder.

Podcast

20VC: David Friedberg on business value creation and running an incubator

David Friedberg always does an exceptional job of simplifying complex stuff. Here he talks through his simplified framework of evaluating businesses, how he's working to commercialize cutting-edge research with TBP, and various other macro-assessments.

While simplified, I liked his step-by-step way of framing how he thinks about business value creation with these questions:

Technical competency – can you build the product?

Product Market Fit – Do customers want your product?

Scalability – Can marketing dollars sustainably help you reach more people?

Profitability – As you scale, do you have levers to crank up gross margins?

Platform potential – Is there a viable path for you to capitalize on your network to build multiple products, partnerships, and customer bases?

Thank you for reading through! As always, any feedback you send my way is incredibly helpful.

See you in 2 weeks,

Aqil

Love it as always!